Market Memo

January 2023 – By Kyle Rohrwasser

I think everyone is happy to put 2022 behind them. 2023 is here but it will come with some new tax law changes. The Secure ACT 2.0 has made major changes to employee benefits, retirement accounts, and the distribution of them. Below are some of the major changes to be aware of in 2023. All are positive to the American employee and can help with future retirement distribution planning.

SECURE ACT 2.0 – Updates

- The age to start taking Required Minimum Distributions (RMDs) increases to age 73 in 2023 and to 75 in 2033.

- The penalty for failing to take an RMD will decrease to 25% from 50% of the RMD and will decrease to 10% if corrected in a timely manner.

- Starting in 2024, RMDs will no longer be required from Roth accounts in employer retirement plans.

- Catch-up contributions will increase in 2025 for 401(k), 403(b), governmental plans, and IRA account holders.

- Unused 529 (college savings accounts) assets can be moved into a Roth IRA. Subject to yearly annual Roth contribution limits and lifetime limits of $35K.

- Starting in 2024, employers will be able to “match” employee student loan payments with matching payments to a retirement account, giving workers an extra incentive to save while paying off educational loans.

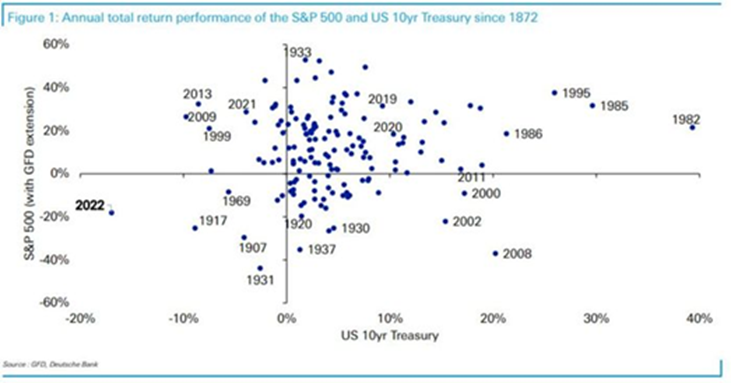

With the quick increase of rates over the last year, fixed income saw its worst year on record while the S&P 500 had its third worst year since 1980. It was one of the more painful years in recent history as fixed income failed to provide support to a falling equity market. Combined, it produced one of the worst years for the 60/40 portfolio (60% equity, 40% fixed income) ever.

As we look to 2023 the scenery has changed drastically from January of 2022. Valuations have returned to historically average levels (relative to current expected earnings) and low-risk fixed-income securities are offering 4%+ creating some buffer for future performance. We are starting to see what a 4% rate hike in less than a year accompanied by the removal of Quantitive Easing can do to the global economy and financial markets. We are seeing more layoffs, reduced earnings expectations, CPI (inflation index) data starting to regress, home prices are trending downward, car prices have begun to fall, credit card debt and their interest rates are increasing, etc… These trends are proving that the actions of the Federal Reserve are working, but they will still take time to fully be reflected in the economy.

Since the marketplace trades in advance of the economy, the ideal scenario that is still on the table is a “soft” economic landing. We are still in the mindset that the Fed will control a lot of the market movement based on what it does regarding hikes, pausing, and subsequent cuts. Same rhetoric as I have stated in past articles, bad news has become good news as it implies that the more economic indicators struggle, the closer we are to getting to the bottoming of the economic cycle.

We still approach the market with a cautious diversified approach as these massive interest rate changes have yet to show their full effect and will take time to fully reprice all assets. We expect the economy to slow while we see CPI come to more acceptable levels, possibly even seeing some deflationary months. Once the Fed is satisfied, we are optimistic that the market valuations will normalize along with the yield curve. With less uncertainty on rates, we will move towards the recovery phase of the economy.

This material is for informational purposes only. It is not a recommendation or solicitation to buy or sell any securities. Vantage Financial is not a tax advisor; please consult your tax advisor prior to making any investment decisions. Vantage Financial is an Investment Advisory Firm registered with the Securities and Exchange Commission (“SEC”). SEC registration does not imply any particular level of skill or expertise.