June 2022 – Scott Rosenquist, CFA®

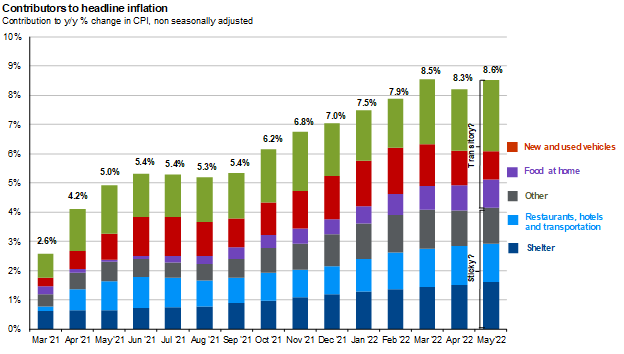

The consumer price index (CPI) for the month of May came in higher than expected. The headline number was up 8.6% over the last year showing the largest increase in decades as price increases were broad based with gas, food and shelter contributing the most. Investors were looking for signs of inflation peaking but will have to remain patient as economic conditions continue to tighten. The Federal Reserve has signaled several interest rate increases over the coming months while also starting to reduce the size of their balance sheet. This process will take time to filter through the economy although the market has anticipated this and reflected across several financial asset classes. The Federal Reserve meets this week and investors are looking to see if they act more aggressively than previously signaled to combat rising prices.

The chart from J.P. Morgan shows the contributions to the CPI number and breaks it down by what can be considered sticky inflation and transitory. Federal Reserve Chair Jay Powell retired the term transitory late last year while in front of Congress as it became clear that inflation is more persistent than previously thought. Another way to view this is core inflation vs. headline inflation. It is common for economists and policy makers to view core inflation by removing food and energy which can be volatile. The spread between headline inflation and core has widened given the large increases in the price of energy and food over the last year.

Source: BLS, J.P. Morgan Asset Management. Contributions mirror the BLS methodology on Table 7 of the CPI report. Values may not sum to headline CPI figures due to rounding and underlying calculations. “Shelter” includes owners equivalent rent and rent of primary residence. “Other” primarily reflects household furnishings, apparel and medical care services. Guide to the Markets – U.S. Data are as of June 10, 2022.

There are several factors influencing inflation including an economy coming out of a pandemic shutdown as consumers shift their spending from goods to services while the war in Ukraine has caused food and energy prices to rise significantly. China’s strict Covid policies continue to hamper supply chains. The emergency monetary and fiscal measures taken during the pandemic have also fed into inflation. Inflation data has become the most watched economic release pushing aside employment data for now. Inflation readings pre-Covid were around two percent. Now that inflation has taken hold in more areas of the economy, the question becomes where does it settle in? That will largely depend on how aggressive the Fed becomes in tightening policy and how the war in Ukraine unfolds.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendation for any individual. Although general strategies and / or opinions are revealed, this post is not intended to, nor does it represent or reflect, transactions or activity specific to any one account. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results. All data and information is gathered from sources believed to be reliable and is not warranted to be correct, complete or accurate. Investments carry risk of loss including loss of principal. Past performance is never a guarantee of future results.